What to Do After Fire Damage?

Fire Damage can be devastating, and we are committed to providing expert guidance and support, ensuring you have the knowledge and resources to navigate through the challenges of fire damage and restore your peace of mind.

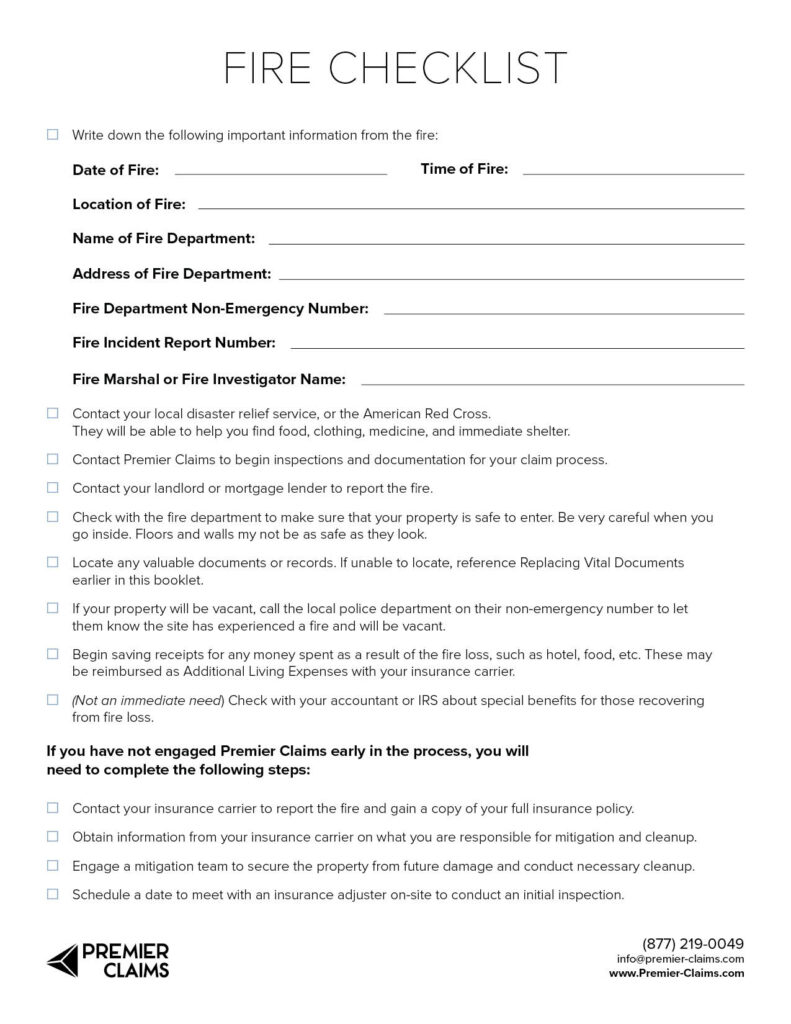

Explore our curated series covering every facet of fire damage. Our expert Fire Checklist ensures your preparedness!

To learn more about navigating fire damage, check out the following articles:

Navigating Fire Damage: Proactive Protection

Navigating Fire Damage: After the Damage Occurs

Navigating Fire Damage: Recovering Contents