NAVIGATING THE STORMS TOGETHER

Reflecting on a Year of Advocacy, Resilience & Results

This year, our team has exemplified the true value of expertise and advocacy in the claims process. By meticulously documenting every detail, negotiating with carriers, and ensuring that our clients, the policyholders, always come first, we’ve been able to deliver results that matter. Our focus on protecting our clients’ rights and helping them navigate the often-complex insurance landscape has reaffirmed why having a trusted advocate is so crucial during challenging times.

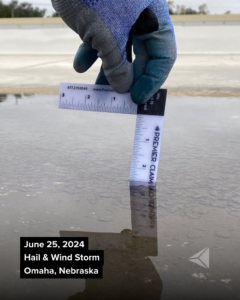

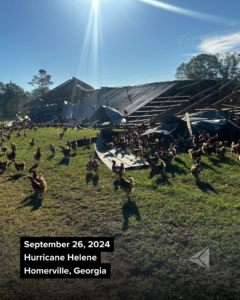

From the devastating tornadoes that ravaged the Midwest in the spring, to the powerful hurricanes whose impact extended far inland, and the intense wind and hailstorms that struck communities across the nation, standing by our clients every step of the way. We are incredibly grateful for the trust our clients have placed in us and the opportunity to help them rebuild.

As a year in review, we’ve included some photos of the damage and storms we’ve worked on throughout the year. These moments reflect not only the challenges we’ve faced together but also the resilience and determination of our team and clients. We are deeply thankful for the hard work of our team, the trust of our clients, and the collective efforts of everyone who has helped advocate for policyholders.

Below are a few articles we’ve published this year to help spread awareness and education:

Will My Insurance Premiums Go Up? – Learn if your premiums will go up if you seek professional help in navigating the claims process.

Filing a Claim Without Losing Coverage: Know Your Rights – The misconception is that an insurance carrier will drop you if file a claim, but its important to understand that such action is unlikely and illegal.

Are You Underinsured? – Recent market changes—skyrocketing construction costs, supply chain delays, and increasing natural disasters—mean your coverage from two years ago may not cover you today.

Depreciation in Insurance Claims: Are You Getting Short-Changed? – When your property is damaged and you file an insurance claim, but you may quickly discover the insurance carrier short-changes you because of depreciation.

The Role of a Public Adjuster vs Insurance Adjuster – Understanding the role of a Public Adjuster versus an Insurance Carrier Adjuster can make all the difference in how much you get paid.