Water damage is one of the most common and potentially devastating issues property owners face. Whether it’s due to a burst pipe, heavy rainfall, or a faulty appliance, water damage can wreak havoc on your property. Understanding your insurance coverage is crucial in such situations. We will delve into the intricate details of water damage coverage, so that you, as a policyholder can be better informed and prepared in the event of water damage.

Types of Water Damage Coverage

Sudden and Accidental Damage

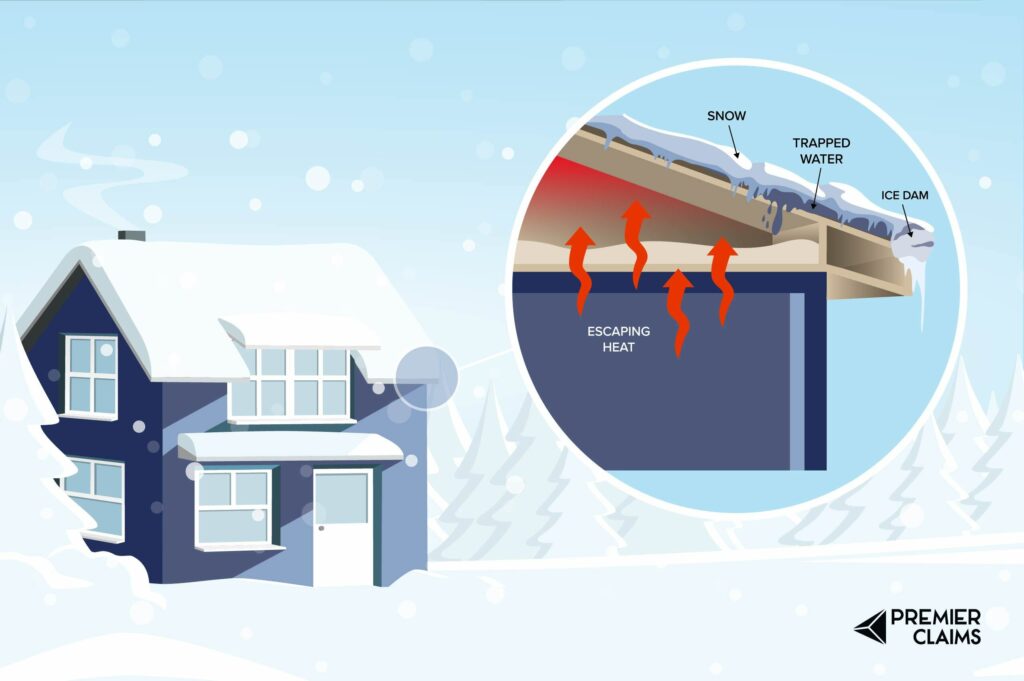

Most standard property insurance policies cover sudden and accidental water damage. This includes situations like a burst pipe, a malfunctioning appliance, or a sudden leak in the roof. However, coverage might vary based on the specific cause, so it’s essential to understand the policy terms.

Flood Damage

It’s important to note the standard insurance policy typically does not cover flood damage. For protection against floods, a separate flood insurance policy from the National Flood Insurance Program (NFIP) is necessary. Furthermore, if you live in a flood-prone area, investing in flood insurance is highly recommended.

Sewer Backup

Sewer backups can cause significant damage to your property. Some insurance policies offer coverage for sewer backups, but it’s often an optional add-on. Check your policy to see if this coverage is included or consider adding it for comprehensive protection.

Understanding Coverage Limits

Even if your policy covers water damage, there are often limitations to the coverage. These limitations may include caps on the total payout, restrictions on certain types of water damage, or higher deductibles for specific causes. It’s crucial to review your policy documents carefully to understand these limitations and assess if additional coverage or policy adjustments are necessary to align with your financial situation & strategy.

Preventing Water Damage

Regular Maintenance

Regularly inspect and maintain your property, checking for signs of leaks, deteriorating pipes, or faulty appliances. Consequently, addressing issues promptly can prevent significant water damage.

Install Proper Drainage Systems

Ensure your property has adequate drainage systems, including gutters, downspouts, and sump pumps. Therefore, proper drainage can redirect water away from your property, reducing the risk of water infiltration.

Educate Tenants

If you rent your property, educate tenants about the importance of reporting leaks promptly. Simultaneously, in your own residence, ensure family members are aware of water-saving practices and how to shut off the main water supply in emergencies.

Being well-informed about your water damage coverage is the first step in protecting your property and assets. Regular policy reviews, understanding coverage limitations, and investing in additional coverage where necessary can provide peace of mind. By taking preventive measures and staying informed, policyholders can minimize the risks associated with water damage and ensure a swift and effective response in case of emergencies. Remember, a well-informed individual can better protect their property. Stay informed, stay vigilant, and safeguard your property against the unexpected challenges of water damage.