Wondering How Long a Hurricane Insurance Claim Takes to Settle?

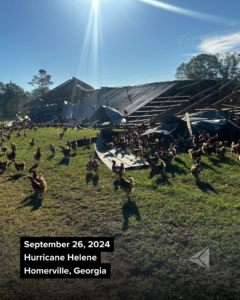

Follow as we track the series of events after Hurricane Helene and the insurance claim process for a complex claim in Homerville, Georgia. Comprised of two large buildings, the layer chicken farm experienced significant destruction that resulted in many of the birds roaming outside a secure enclosure, or lost due to the damage.

Timeline to Recovery following a Hurricane Insurance Claim

Layer Chicken Farm in Homerville, Georgia

26 September 2024

11:10 PM — Hurricane Helene made landfall in Keaton Beach, Florida.

27 September 2024

2:45 AM — Hurricane Helene impacts Homerville, Georgia.

30 September 2024

11:31 AM — Premier Claims conducted on—site inspection, and gathered initial documentation (policy declaration pages, and business related documents).

12:43 PM — Premier Claims established representation with the carrier and requested contact information for the carrier adjuster assigned to the claim.

1:21 PM — Premier Claims confirmed coverage for mitigation, and worked with the contractor selected by the policyholder to begin mitigation efforts.

01 October 2024

10:23 AM — Premier Claims client specialist conducted a welcome call with the policyholder to discuss the process, our team members and their role in their claim, the initial mitigation coverage and next steps in the process.

2:02 PM — Premier Claims established communication with the carrier adjuster, and requested a certified copy of the full policy, scheduled joint inspection, and confirmation of policy limits.

03 October 2024

8:03 AM — Premier Claims inspector met on-site with the independent adjuster hired by the insurance carrier to conduct a more thorough inspection to ensure all damage was documented and considered by the carrier.

10:17 AM — Premier Claims gathered documentation for the most recent cost of repairs and service for damaged equipment.

1:59 PM — Premier Claims secured a written email confirmation from the independent adjuster that the buildings are classified as a total loss, as well as additional equipment on site.

04 October 2024

8:07 AM — The carrier reassigned the farm equipment parts of the claim to an additional adjuster that requested additional information to process the claim.

9:55 AM — The carrier reassigned the business interruption coverage of the claim to an outside forensic accounting firm.

10:57 AM — Due to the equipment coverage being reassigned to a new adjuster, Premier Claims inspector went back on—site to gather more photographic and video evidence of agricultural equipment that was damaged.

2:28 PM — Premier Claims received the certified copy of the full insurance policy, and our legal team began their thorough review of the policy. During their review, they identified the policyholder held an ACV policy, but was able to recoup a 5% debris removal after completion.

3:36 PM — Premier Claims adjuster spoke with the forensic CPA to discuss the business interruption coverage. As a result, we received the full list of necessary information they will require for this claim, business, and agricultural type. We coordinated with the policyholder to start compiling the necessary documentation.

09 October 2024

8:19 AM — Premier Claims received a final negotiated estimate totaling full policy limits for the structural damage, as well as 5% in debris removal to be issued following completion.

10 October 2024

3:15 PM — Policyholder compiled a portion of documentation for business interruption coverage. We continue working with policyholders to compile financial documents necessary to receive business interruption coverage.

11 October 2024

11:24 AM — Premier Claims adjuster followed up with the insurance carrier on releasing undisputed funds. Told to be in transit by the end of next week.

17 October 2024

8:14 AM — The carrier has reassigned the farm equipment parts of the claim to an additional adjuster. This is the third adjuster reviewing the coverage for the equipment.

18 October 2024

11:12 AM — Premier Claims adjuster followed up with the insurance carrier on releasing undisputed funds that were promised to be mailed last week.

23 October 2024

11:28 AM — Premier Claims secured written confirmation that full limit coverage for the equipment. Carrier will be purchasing equipment for the full coverage limits through a bill of sale.

24 October 2024

11:08 AM — Premier Claims received confirmation that the carrier has released an initial payment for the structure and equipment settlement.

29 October 2024

10:15 AM — Premier Claims received the executed bill of sale from the policyholder and delivered it to the carrier and requested a full release of payment for the equipment.

01 November 2024

2:15 PM — Premier Claims received initial payment from the carrier. Team overnighted check for endorsement from the mortgage company.

Ongoing Efforts

1 — Premier Claims client specialist continues to work with the policyholder to organize and gather the necessary historical financial information to receive business interruption coverage.

2 — Premier Claims adjuster is working closely with the contractor to compile all invoices and completion documents to issue release of 5% debris removal funds.

3 — Premier Claims advising the policyholder to secure a more inclusive policy that contains recoverable depreciation and adequately covers the needs of poultry farms.

Read More Trending Articles