To protect yourself in the event of a future hurricane, one of the most important ways you can prepare is by reviewing your policy coverage. For Hurricane Preparedness Week, we will outline a few of the key aspects to consider in your policy: deductible, building coverage, and the importance of inspecting your property with photo documentation.

Deductible

Hurricane coverage deductibles are either be a fixed dollar amount or a percentage of the insured value. Percentage deductibles are more common as they will not increase premiums as much as a fixed dollar amount deductible. However, if you’re located in a hurricane prone area, it is crucial to know what type of deductible is in your policy and the financial responsibility you would have if a hurricane damaged your property.

For instance, say you have $400,000 in coverage to your building and your policy has a 2% deductible. After a hurricane, your insurance claim is settled at $50,000 for property damage, but you receive a check for $42,000 — You’re responsible for paying the percentage deductible of $8,000 out-of-pocket to restore your building.

Building Coverage

Building coverage is an essential part of any policyholder’s insurance policy. It provides protection for the structure of your home, including the roof, walls, foundation, and other structures such as a garage or shed. In the event of a hurricane, this coverage will help you repair or rebuild your home if it is damaged.

The amount of building coverage you need will depend on a variety of factors, including the size of your home, the materials it is made of, and the cost of construction in your area. As a general rule, you should have enough coverage to rebuild your home from the ground up if it is completely destroyed. An Actual Cash Value policy pays what your property is worth today, whereas a Replacement Cost Value policy will pay the cost to repair or replace your property without deducting for depreciation. To learn more, visit our blog “What is Recoverable Depreciation?”

Flood Damage Insurance

Another factor to consider when purchasing building coverage is whether your policy includes coverage for flood damage. Flooding is a common occurrence during hurricanes, and it can cause significant damage to your home. If you live in a flood-prone area, you may want to consider purchasing a separate flood insurance policy to ensure that you are fully protected.

Coverage Limits and Exclusions

When purchasing building coverage, it’s important to read your policy carefully and understand the coverage limits, and exclusions. For instance, a roof exclusion could specify that the insurance carrier will not pay for damages to the roof as a result of wind or other events, such as a hurricane. A cosmetic exclusion could put you at risk of having to justify the necessity for repairs or replacement if the insurance carrier classifies the damage as cosmetic.

Policy Requirements

You should also be aware of any requirements your insurance company may have for hurricane preparations, such as installing storm shutters or reinforcing your roof. Failure to do any hurricane preparations can put you at risk for a denied or underpaid claim. Read more in yesterday’s blog, “Prepare before the storm”

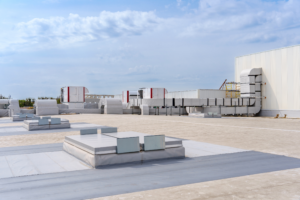

Property Current Condition

One of the most important steps that is often overlooked by policyholders is to get their property inspected and take pictures before a hurricane hits. Doing so can provide solid evidence of the condition of their property before the hurricane and make it easier to assess the damage caused by the hurricane.

Here are a few reasons why it is essential to get your property inspected and take pictures before a hurricane:

- Documentation of property condition: By getting your property inspected and taking pictures, you can document the condition of your property before the hurricane. This can be helpful when filing a claim with your insurance carrier, as it provides clear evidence of the state of your property before the storm hit. This includes documenting and taking pictures of personal property that is included in your policy.

- Evidence of damage: By having pictures of your property before the hurricane, you can provide solid evidence of the damage caused by the hurricane. This evidence can help expedite the process and ensure that you receive the compensation you deserve.

- Accurate assessments: By having pictures of your property before the hurricane, you can ensure that inspectors and adjusters have an accurate picture of the extent of the damage caused by the hurricane. This is critical when negotiating estimates and showing every aspect of the structure that needs to be repaired or replaced per your policy.

The Good News

Our team provides free policy reviews and property inspections. If you have concerns over your current insurance policy, our team of legal experts will complete a thorough review and outline potential gaps in coverage or risks. Our inspection & adjusting team will gather the necessary documentation and pictures required prior to any hurricane damage. In addition, we will continue to monitor your property, and in the event you experience severe damage, we begin the claim process on your behalf immediately to get you paid faster. Contact us today to get your free policy review and inspection!