IN RECENT NEWS

On today’s episode of the Butch and Bob Show on Big Dog Country station in Georgia, one of our most experienced and valued policyholder advocates, Caitlyn Milligan discusses the restoration efforts following Hurricane Helene.

On today’s episode of the Butch and Bob Show on Big Dog Country station in Georgia, one of our most experienced and valued policyholder advocates, Caitlyn Milligan discusses the restoration efforts following Hurricane Helene.

In this insightful discussion, Kyle Maring, CEO of Premier Claims, sits down with a representative from HailTrace to discuss the impact of Hurricane Helene. They explore the current challenges faced by affected communities and outline the crucial next steps for restoration and recovery efforts. Tune in to hear their professional perspectives on navigating the aftermath of such a devastating storm.

In the wake of Hurricane Helene’s unprecedented destruction, thousands of homeowners are not just picking up the pieces of their lives—they’re bracing for a new kind of storm: the battle with their insurance carriers. While families are still reeling from the devastation, a darker, more troubling reality is unfolding. Will their insurance policies—the safety nets they’ve invested in for years—come through when they need them most?

If history is any indication, the answer might leave you unsettled. CBS’s recent 60 Minutes exposé on Hurricane Ian revealed how insurance carriers systematically underpaid or outright denied policyholders. They altered damage assessments to reduce payouts. With Hurricane Helene’s damage mirroring, if not exceeding, Ian’s, homeowners must now confront the possibility that they, too, could face the same unfair treatment.

As you begin the recovery process, it’s crucial to know how to protect yourself from an industry that may prioritize profits over people.

According to the episode, many policyholders found that their damage reports were mysteriously altered, underestimating the destruction to their properties. As the whistleblowers interviewed in the episode noted, insurance carriers deployed tactics that included modifying damage estimates—sometimes drastically—to minimize the compensation owed to homeowners. A contractor featured in the episode shared, “The damage was clear, but what wasn’t clear was why the estimates didn’t match reality anymore.”

As evidenced in the 60 Minutes episode, policyholders from Hurricane Ian are still battling their insurance carriers for the compensation they were promised. These delays and reductions in payouts can be financially crippling at a time when people need help the most.

The question on everyone’s mind now is: Could this happen again with Hurricane Helene? Unfortunately, the current insurance climate suggests that it’s not just a possibility, but a strong likelihood.

Given the current landscape, there are several things policyholders should keep in mind when navigating the claims process after Hurricane Helene:

As we watch Hurricane Helene’s devastation unfold, property owners must brace themselves for the physical recovery and the potential financial battle ahead. In many cases, it’s not about how much damage was done but how much insurers are willing to acknowledge.

We encourage policyholders to stay informed, know their rights, and reach out to professionals when in doubt. The lessons from Hurricane Ian should serve as a grim reminder: proactively know the coverage and rights within your policy so you know when it’s time to defend your claim.

Water damage is one of the most common and potentially devastating issues property owners face. Whether it’s due to a burst pipe, heavy rainfall, or a faulty appliance, water damage can wreak havoc on your property. Understanding your insurance coverage is crucial in such situations. We will delve into the intricate details of water damage coverage, so that you, as a policyholder can be better informed and prepared in the event of water damage.

Most standard property insurance policies cover sudden and accidental water damage. This includes situations like a burst pipe, a malfunctioning appliance, or a sudden leak in the roof. However, coverage might vary based on the specific cause, so it’s essential to understand the policy terms.

It’s important to note the standard insurance policy typically does not cover flood damage. For protection against floods, a separate flood insurance policy from the National Flood Insurance Program (NFIP) is necessary. Furthermore, if you live in a flood-prone area, investing in flood insurance is highly recommended.

Sewer backups can cause significant damage to your property. Some insurance policies offer coverage for sewer backups, but it’s often an optional add-on. Check your policy to see if this coverage is included or consider adding it for comprehensive protection.

Even if your policy covers water damage, there are often limitations to the coverage. These limitations may include caps on the total payout, restrictions on certain types of water damage, or higher deductibles for specific causes. It’s crucial to review your policy documents carefully to understand these limitations and assess if additional coverage or policy adjustments are necessary to align with your financial situation & strategy.

Regularly inspect and maintain your property, checking for signs of leaks, deteriorating pipes, or faulty appliances. Consequently, addressing issues promptly can prevent significant water damage.

Ensure your property has adequate drainage systems, including gutters, downspouts, and sump pumps. Therefore, proper drainage can redirect water away from your property, reducing the risk of water infiltration.

If you rent your property, educate tenants about the importance of reporting leaks promptly. Simultaneously, in your own residence, ensure family members are aware of water-saving practices and how to shut off the main water supply in emergencies.

Being well-informed about your water damage coverage is the first step in protecting your property and assets. Regular policy reviews, understanding coverage limitations, and investing in additional coverage where necessary can provide peace of mind. By taking preventive measures and staying informed, policyholders can minimize the risks associated with water damage and ensure a swift and effective response in case of emergencies. Remember, a well-informed individual can better protect their property. Stay informed, stay vigilant, and safeguard your property against the unexpected challenges of water damage.

Severe weather events, such as hailstorms, have become increasingly more common and devastating in recent years. As we enter an era where the cost of insured losses from severe storms continues to rise, it becomes crucial for property owners to act promptly after a date of loss. Get ready to explore the significance of taking immediate action in the wake of extreme weather like this year’s hail storms, gain insights on the rising costs of storm damage, and discover valuable guidance on protecting your property.

When faced with property damage caused by hail or other severe weather, time is of the essence. Acting promptly allows you to:

Hailstorms have had a significant financial impact, with insured losses skyrocketing in recent decades. Gallagher Re, a reinsurance firm, reports insured losses from hail exceeding $10 billion since 2008. In 2023 alone, insured losses from severe convective storms are projected to surpass $30 billion. With the growing number of severe weather events, it’s crucial to be proactive in protecting your property and securing the necessary coverage.

To safeguard your property and ensure a smooth claims process, consider the following steps:

Acting promptly after a date of loss is essential to protect your property and ensure a smooth claims process. With the increasing costs of severe weather events, it’s crucial to be proactive in securing the necessary coverage and taking immediate steps to mitigate further damage. By documenting the damage, reporting the loss promptly, and seeking assistance from a Public Adjuster, you can navigate the claims process with confidence.

Remember, time is of the essence when it comes to protecting your property from severe weather-related losses. Act promptly, protect your investment, and fight for the coverage you deserve. If you have any questions, please reach out to our team today.

Understanding when to hire a public adjuster is the first strategic move in your claim process. Every decision plays a role in the pursuit of fair compensation for your property damage. We unravel the layers of timing – from the initial moments of property damage to the complexities of denied claims.

Before going into the timing aspects, it’s crucial to comprehend the role of a public adjuster. These professionals act on behalf of policyholders, assessing and negotiating insurance claims aiming to earn a fair compensation for property damage. Their experience in the claims process can make a significant difference in the outcome.

Swift action is vital when property damage occurs. While policyholders might be tempted to start the claims process independently, involving a public adjuster from the start can streamline the process. A public adjuster’s early involvement aims to make a thorough assessment of the damage, setting the stage for a comprehensive and well-documented claim.

Policyholders often question when is the right time to bring in a public adjuster. Ideally, it’s before filing a claim. By consulting with a public adjuster beforehand, you benefit from their expertise in evaluating policy coverage, estimating potential damages, and strategizing the most effective approach. This proactive step can significantly impact the outcome of your claim.

If your insurance claim has been denied or you feel the compensation offered is inadequate, it’s not too late to hire a public adjuster. These professionals excel in reevaluating claims, identifying discrepancies, and negotiating on behalf of policyholders. Their involvement can lead to a fair resolution and the compensation you rightfully deserve.

Insurance policies can be intricate, and navigating complex claims requires a deep understanding of the language and nuances within. Hiring a public adjuster becomes crucial when faced with intricate claims, aiming for every detail is thoroughly examined, and your interests are protected.

Premier Claims encourages policyholders to consider engaging a public adjuster early in the process or, if needed, at any point when challenges arise. Our team stands ready to provide the expertise and guidance necessary for the intricacies of the claims journey. Don’t wait; connect with Premier Claims today for a smoother, more informed claims experience.

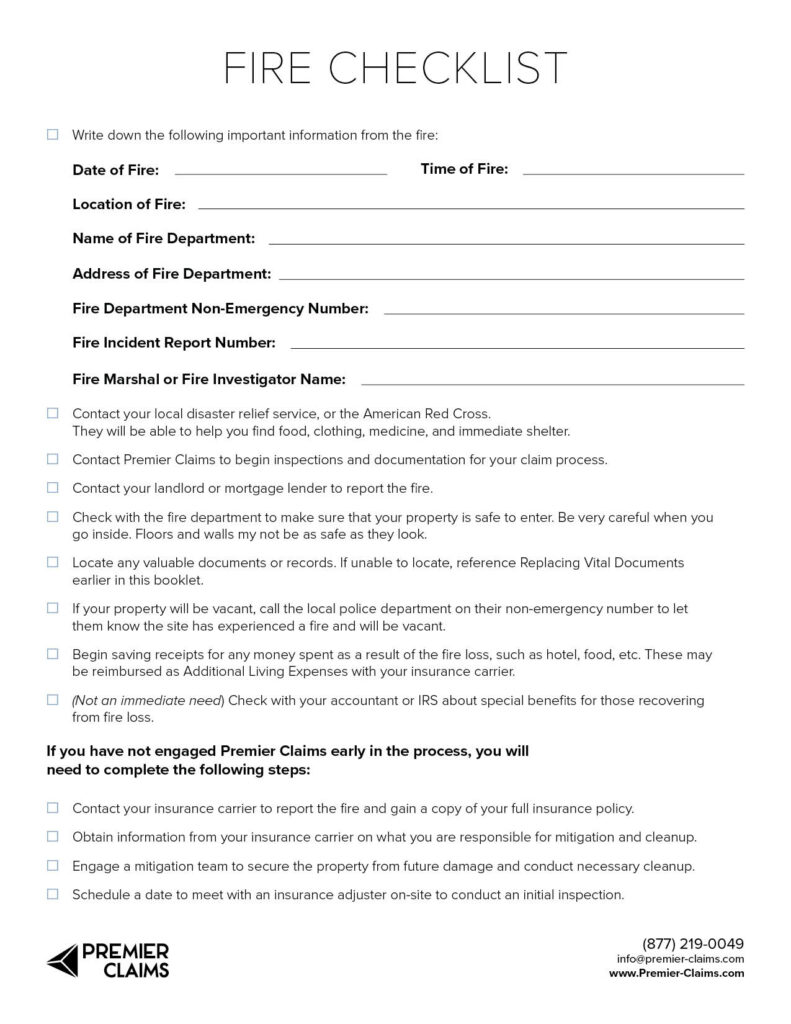

Fire Damage can be devastating, and we are committed to providing expert guidance and support, ensuring you have the knowledge and resources to navigate through the challenges of fire damage and restore your peace of mind.

Explore our curated series covering every facet of fire damage. Our expert Fire Checklist ensures your preparedness!

To learn more about navigating fire damage, check out the following articles:

Navigating Fire Damage: Proactive Protection

Navigating Fire Damage: After the Damage Occurs

Navigating Fire Damage: Recovering Contents

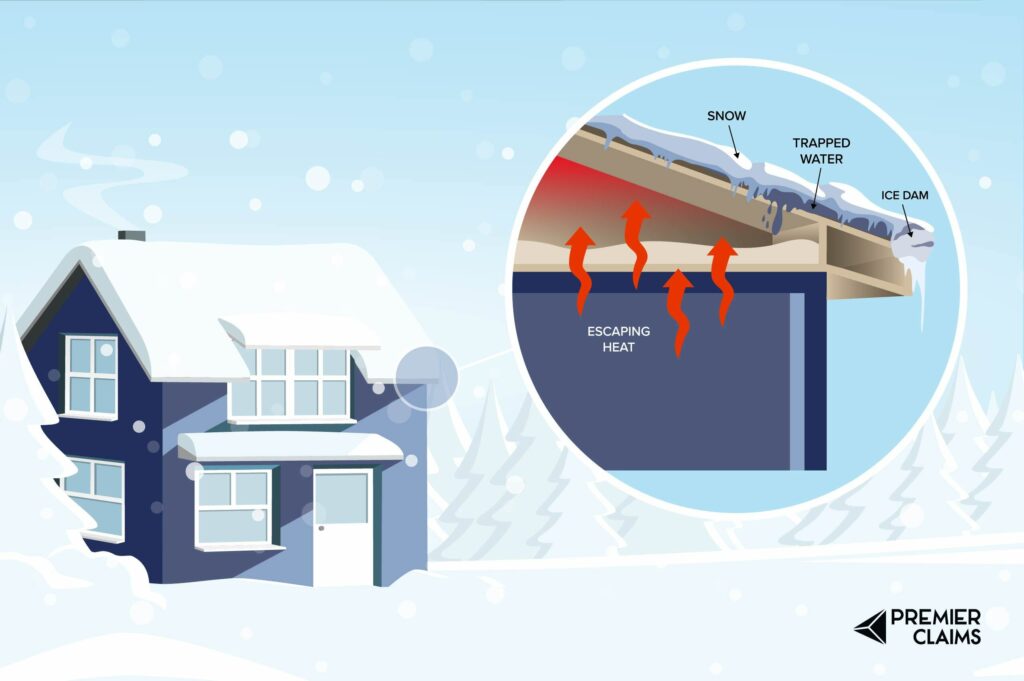

Winter brings its own set of challenges, and one particularly troublesome issue for property owners is the formation of ice dams. While they may seem innocuous at first, ice dams can lead to significant hidden damages if not addressed promptly. In this guide, Premier Claims sheds light on the causes of ice dams, the potential damages they can cause, and actionable tips to protect your property.

Ice dams typically form when warm air from the interior of a building escapes into the attic, causing the underside of the roof to warm. This warmth, in turn, causes snow on the roof to melt. When the melted snow reaches the colder eaves, it refreezes, creating a dam. Subsequent melting snow can then pool behind this dam, potentially seeping into the property.

The repeated freezing and thawing of water can compromise the integrity of your roof. Over time, this may result in leaks, structural damage, and the need for extensive repairs.

Ice dams can lead to water infiltration into the attic, damaging insulation and promoting mold growth. This can affect the overall energy efficiency of your property.

Seeping water can find its way into the interior of your property, causing damage to ceilings, walls, and even valuable belongings.

Ensure your attic is properly insulated to minimize heat transfer from the interior. This helps maintain a consistent roof temperature, preventing snowmelt and ice dam formation.

Proper attic ventilation promotes temperature disruption on the roof, reducing the likelihood of ice dam formation. Consult with roofing professionals to assess and improve your property’s ventilation.

Keep your roof in top condition by removing snow promptly after storms. Use roof rakes or hire professionals to prevent excessive snow buildup, lowering the risk of ice dam formation.

Schedule regular inspections to identify and address potential issues before they escalate. Swift intervention can save from costly repairs in the long run.

Understanding the causes and hidden damages of ice dams empowers property owners to take proactive measures. By implementing these tips and staying vigilant, you can safeguard your property from the detrimental effects of ice dams. If you ever encounter damages, our experienced team is ready to guide you through the claims process with professionalism and care. Don’t compromise your peace of mind; take action today.

Remember, for any property damage concerns, Premier Claims is your trusted partner, offering industry-leading guidance and support.

Our team understands that after a fire, the loss extends beyond just the structure—it reaches every item that makes a space feel like home or a business function seamlessly. We aid in creating a detailed content inventory of all affected items, ensuring nothing is overlooked. With this comprehensive list in hand, we then provide a rigorous evaluation to insurance carriers. This allows us to advocate for our clients to obtain full reimbursement for each content item. Our commitment is to secure recovery, not just from the structural loss, but from the personal and operational disruptions the fire may have caused.

Most homeowners or business owners haven’t prepared a detailed inventory of their possessions before experiencing a substantial loss — and that’s perfectly understandable. Our team excels in employing innovative methods to assist in assembling a thorough inventory. Below are some strategies and suggestions we offer our clients following a major fire incident:

While our team is committed to assisting with a wide range of post-loss concerns, we cannot directly help in replacing personal identification and essential documents. However, we are more than happy to guide you in the right direction to secure replacements. Below is a handy list detailing where you can obtain replacements for various vital documents:

| Vital documents | Where to get a replacement |

|---|---|

| Drivers License or State Id | Local Department of Motor Vehicles |

| Government Id | Locate your nearest Real-Time Automated Personnel Identification System (RAPIDS) site |

| Military Discharge Papers | Department of Veterans Affairs 1-800-827-1000 |

| Passports | State Department—Passport Services 1-202-955-0430 |

| Birth, Death, and Marriage Certificates | Appropriate State Bureau of Records |

| Social Security or Medicare Cards | Local Social Security Office 1-800-772-1213 |

| Credit Cards | Mastercard & Visa: Contact the issuing financial institution American Express: 1-800-441-0519 Discover: 1-800-DISCOVER (1-800-347-2683) |

| Titles to Deeds | Records department of the area/county in which the property is located |

| Stocks and Bonds | Issuing company or your broker |

| Wills | Attorney or probate court where the will was filed |

| Income Tax Records | Internal Revenue Services (IRS): 1-800-829-1040 Accountant |

| Citizenship Papers | Bureau of Citizenship and Immigration Services: 1-800-375-5283 |

| Mortgage Papers | Lending Institution |

Assistance might be available to help clean and eliminate smoke odors from items affected by the fire. This depends on the specifics of your insurance policy and the capabilities of your mitigation service provider. To make things easier for you, we’ve shared a few helpful hints to support the cleanup procedure when recovering contents from fire damage: